Case study • The Ultimate Money Bestie | Product Design

The Money Bestie | 0–1 Mobile Product Design

Empowering women to take control

of their finances with AI

I partnered closely with the founder and engineering team to design a financial app focused

on helping users build healthier financial habits.

Leading the end-to-end product design, I shaped the UX and visual direction to create a clear,

supportive experience around spending, goal setting, and financial decision-making.

The result was a more approachable and confidence-driven product, positioning personal finance

as accessible, structured, and easy to engage with.

Role:

Founding Product Designer (0→1)

Platform:

iOS

Scope:

End-to-end product design, UX strategy,

and visual Design system

(branding, UI, prototyping)

Duration:

10 months

About the Product

The Money Bestie is a mobile app designed to help women take control of their finances through education, personalised guidance, and AI-driven support. The product focuses on building financial confidence by simplifying complex financial concepts, supporting everyday decision-making, and helping users develop healthier money habits.

The main Product challange:

Managing personal finances is often overwhelming, especially for users who lack financial knowledge, confidence, or clear guidance.The challenge was to design a product that makes financial decision-making feel approachable, structured, and supportive — while simplifying complex financial information into clear, actionable steps.

The Problem

Women often lack access to tools that guide them through managing their finances

in a clear and supportive way. Financial decision-making can feel complex

and overwhelming, with little structured guidance to build confidence,

develop habits, or take action.

Design strategy

Focusing on women’s financial challenges and behaviours, I structured the product

around clear engagement categories that guide users through different types

of actions — from educational steps and practical training to goal-oriented tasks.

This approach helped simplify complex financial information, support progression,

and encourage consistent, confidence-driven decision-making.

PROJECT DETAILS

PROJECT GOAL

To design a product that immediately captivates users through compelling aesthetics and ease of use, while also providing ongoing value, reliability, and adaptability to their evolving needs, leading to both short-term and long-term user attachment.

BUSINESS GOALS

• User Acquisition: Address market demand effectively

• Customer Retention: Enhance customer satisfaction and loyalty.

• Competitive Advantage: Develop innovative features

and experiences that differentiate the product from competitors.

and experiences that differentiate the product from competitors.

• Data collection and analytics: Implement features that gather

user data to guide future business decisions.

user data to guide future business decisions.

METRICS

Daily Active Users

324

over first month

User Retention Rate

34%

over first month

Conversion Rate

22%

over first month

App Store Rating

5.0

over first month

USER RESEARCH

Raquel, 32

Lack of education

" I guess because I'm now much more aware of my financial situation, I feel like I'm losing an opportunity. It's just that I don't have the information and the security to do something different "

Rajani, 38

Lack of control

" It's not nice to make ends meet.

I don't understand why we make so much money, yet we still struggle with debt where we shouldn't be. Where is the money going? "

Kash, 42

Misinformation

" I was getting fragmented information from different people, which made it hard to understand what to do. It felt like I was trying to piece together a puzzle."

Sam, 28

Fear of risk

" I know that I'm not investing and I know that women in general are a bit risk averse and don't tend to invest as much, but it's something that I'd like to do, I know it's higher risk, but higher reward."

Catherine, 34

No habits

" Thinking about money around - feel guilt. I feel like I can’t spend any fun money because it should all go to kids. ADHD - impulsive with spending. Harder to save money. Shouldn't do that. Complex, specific things. Being mom has changed a lot. "

Agata, 31

No confidence

" I haven’t done anything else. I didn’t feel confident doing it. Takes a lot of effort to look at things."

How women’s interactions with products and services can differ from men’s ?

Understanding the differences between men and women in communication, emotional engagement, and decision-making styles is crucial for designing products that effectively meet their needs and foster long-term attachment. It involves recognizing various behavioral, emotional, and social factors. Here are some key differences:

Communication style

Women:

Tend to favor more collaborative and conversational styles, often seeking detailed explanations and feedback. They might engage in discussions and value social support.

Men:

Often prefer direct, concise communication and may focus on problem-solving with less emphasis on collaborative dialogue.

Emotional Engagement

Women:

Generally more emotionally engaged with products and services, seeking features that resonate with their personal values and emotions. They may prioritize products that offer emotional support or connect with their identity.

Men:

May focus more on functionality and efficiency, sometimes placing less emphasis on emotional aspects.

Decision-Making Process

Women:

Often take a more holistic approach, considering how products fit into their overall lifestyle and long-term needs. They may value recommendations from peers or community feedback.

Men:

Might prioritize speed and efficiency in decision-making, focusing on immediate benefits and technical specifications.

Preference for Detail

Women:

Typically appreciate more detailed information and context about products, including user reviews and educational resources.

Men:

May prefer straightforward, high-level information and quick comparisons.

Design Aesthetics

Women:

May place a higher value on design aesthetics, including color schemes, styling, and visual appeal, in addition to functionality.

Men:

Often focus more on the practical aspects of design, such as durability and functionality.

Motivations and Goals

Women:

Might look for products that align with personal goals such as health, family, or lifestyle improvement, and prefer features that support these goals

Men:

Often focus more on the practical aspects of design, such as durability and functionality.

Feedback and Support

Women:

May seek more extensive customer support and follow-up, including personalized assistance and community support.

Men:

May prefer straightforward support solutions and less frequent interaction with customer service.

DESIGN PROCESS: SETTING THE FOUNDATIONS

Our team got together for a brainstorm session to define the app goals and main areas of user engagement.

We all came from different backgrounds - Design, Engineering, Finance, Marketing, so it was great to hear everyone’s perspective on key activities.

We identified our target user personas, which included young professionals, mothers balancing household finances, and women interested in long-term financial planning.

This laid the foundation for a user-centered design that would focus on education, training and empowerment.

By the end of the session, we had a clear vision that would guide us through the next steps.

We identified our target user personas, which included young professionals, mothers balancing household finances, and women interested in long-term financial planning.

This laid the foundation for a user-centered design that would focus on education, training and empowerment.

By the end of the session, we had a clear vision that would guide us through the next steps.

The app should be:

FUNCTIONAL

• Streamline tracking of income, expenses, investments, and savings

• Provide AI-powered personal financial advice and insights tailored to user behavior

• Seamless banking integration and goal-setting features with reminders for bills and milestones

USABLE

• Intuitive, easy-to-navigate user interface

• Simplify complex financial data and support voice/text search

• Include a comprehensive library of financial products (e.g., loans, insurance, investments) with detailed comparisons and recommendations

ENGAGING

• Integrate AI-powered financial advisor to offer personalized tips, nudges, and recommendations

• Include gamification and community features to motivate users

• Foster engagement through tracking financial goals progress

HIGH QUALITY

• Guarantee accurate data, fast performance, and secure, encrypted connections.

• Regular updates based on user feedback and performance

USER FLOWS AND WIREFRAMING

AI support guides users through key areas like understanding money, managing their finances, and dealing with real-life situations in the game.

By mapping out the user’s interaction with these features, I created a smooth, engaging flow:

The user flow formed the foundation of the mobile app's navigation by organizing key activities into easily accessible sections:

Transforming the structure into wireframes created a clear visual guide that brought user flows to life

VISUAL DESIGN

When working on the visuals, my goal was to make finances feel less intimidating. I used bright, vibrant colours to bring a sense of energy and positivity, helping users feel more at ease and open to engaging with their money.

Tone of voice

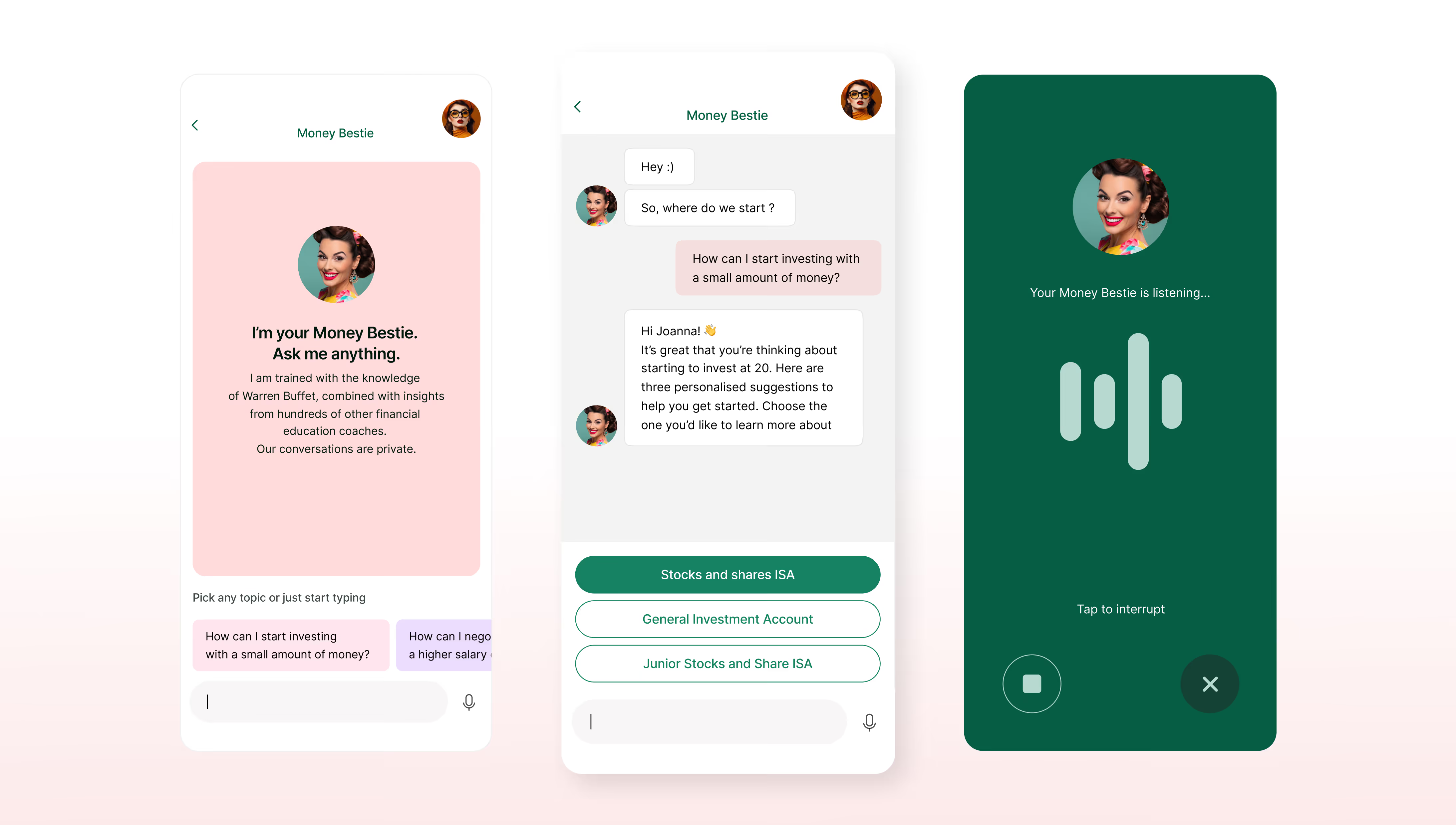

We trained our AI's tone of voice to provide friendly and supportive assistance, so it can respond to users' questions and needs in a warm and approachable way. Just like having a helpful companion by your side.

I applied the same tone across the entire user experience, from onboarding to all the interactions.

I applied the same tone across the entire user experience, from onboarding to all the interactions.

Tracking Finances

Bestie helps users build healthier money habits by guiding them from the very first step. Starting from the home screen, users are encouraged to set clear financial goals — whether it’s saving for a holiday, paying off debt, or building an emergency fund. As they progress, Bestie provides easy-to-read tracking dashboards, timely updates, and personalised financial advice, making it simple to stay motivated and make smarter money choices every day.

Control, Track, and Grow Your Finances

In the Financial Wellness section, users first connect their current accounts securely, creating a real-time view of their money. They’re guided to set custom spending ratios — balancing essentials, non-essentials, and "Future You" investments. As they spend, Bestie automatically tracks and categorises transactions, helping users stay aligned with their goals and build lasting financial habits.